It rhymes

The NASDAQ has climbed astonishingly fast in the past few years. Nvidia is announcing incestuous deals with its customers, OpenAI claims to be deploying hundreds of billions that would be impossible to raise, and quantum computing companies continue to claim they will be the future of computing. But we all know the technology is revolutionary; we’ve used ChatGPT and experienced its exceptional ability to reduce analysis time and handle administrative work. These features are available to anyone for free, with the option to upgrade to the premium version at a monthly subscription cost of tens of dollars. We have been blessed.

But at the same time, cursed.

The adage “if it’s free, you’re the product” somewhat applies to AI. Though I am not a technical expert, I believe that anyone could use common sense to decipher how the LLM business works. OpenAI, which owns ChatGPT, operates in a competitive market. It launched itself as a pioneer in LLM AI chatbot with the release of ChatGPT in 2022, but soon after faced the release of numerous other similarly competent models such as DeepSeek, Gemini, Grok, and Claude. These LLMs are at war to compete for userbase, and thus use the tactic we know tech has been abusing over the past decade: cash for customers. It’s starkly similar to how Uber, DoorDash, Airbnb, and other disruptive technologies obtained market share: subsidize costs, then reprice when dominance is established. Venture capital money from pension funds and other high-net-worth individuals facilitates this transformation. OpenAI, backed by Anderseen Horowitz, Founders Fund, Softbank, and other major VCs, was no different. It just operated at a larger scale. And in arms against titans such as Google, xAI, and META.

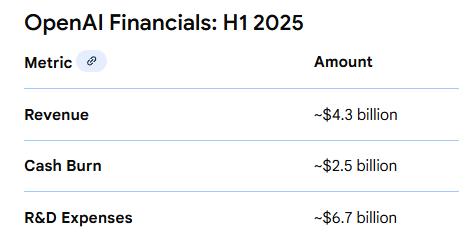

Started as a “non-profit,” OpenAI burns $2.7 for every $1 in revenue. They claim to be accelerating revenues to $20B this year, but that is a doubtful number. Its current valuation of $500-$600B, making it the most valuable private company ever, has raised eyebrows about what the next financing avenue might be to sustain its cash burn. And so it reportedly began talks to IPO at $1T. These numbers keep growing, yet no one seems to be asking the basic questions. What is the ROI on the cash burn, and what if they can’t raise the cash and don’t see a clear path to profitability? We are talking about massive shareholder value destruction here, and soon, debt holders too.

Uber operates in a duopoly alongside Lyft. Both of them operate over 90% of the ride-hailing market in the US. OpenAI has been struggling to keep a lead over newer models from its competitors, and this is its sole business. xAI has Elon Musk behind it, Google, and META, self-explanatory. Yes, Uber IPO’d with continued cash burn since inception and has never been profitable, but the competition at that stage was culled. It did not compete with larger tech giants like OpenAI does.

The media, pushing a sense of an impending intelligence war, exacerbates this euphoria. It’s as if we will soon see the inception of Skynet or Agent Smith after LLMs. And that the winner of the AI race will be the supreme power of the next century. Narratives like this exist throughout history, and fortunately, we have the tools of the internet and AI to refer back to the 99 dot-com bubble to analyse whether this phenomenon is any different.

Though we have seen comparisons of Nvidia to Enron, Nvidia draws more similarities to Cisco. Both stand out as the leading infrastructure picks-and-shovels of their eras and saw explosive growth due to growing needs. I’d like just to simplify things and look at this through the lens of behavioral psychology, because the perception of businesses can often be altered by noise and constant pelting of the media, but behavior is intrinsic. I bring back the Gartner hype cycle.

Gartner Hype Cycle

This pattern exists throughout history and throughout different technologies, revolutions and disruptions.

”We tend to overestimate the effect of a technology in the short run and underestimate the effect in the long run.” - Roy Amara

We most recently encountered this in 2020 and 2021. Remember the clean energy and work-from-home tools era? Peloton, Zoom, Teladoc, Clean energy stocks, EV bubble, etc. Public markets are the channel through which this behavior is most clearly visible, especially at our current stage of the information era. The COVID-19 lockdowns have further driven the global population deeper into the digital world, leading to a massive rise in retail activity through stockbrokers and trading platforms. Furthermore, recently developed platforms provide 24/7 access and a video game-like UI design that encourages risk-taking. Users on some platforms can even view other investor profiles and follow them. Retail trading participation surged from roughly 10-20% of daily trading volume in the U.S markets to over 30%.

eToro profile scanner feature

Five years after COVID, we have now evolved into the fully distilled version of “betting” behaviour: prediction markets. Instead of wagering on events and trends through equities, you can now wager on the specific event itself.

Returning back to our theme in focus, the AI bubble, I believe we are in the last innings of it. Earnings may still be stellar, but when sentiment wanes, capex spending and investment in these spaces will decline. People are starting to feel AI fatigue, and they will begin withdrawing their money before all the chairs disappear.

Looking back, what followed the tech bubble was the commodity boom. When what we’ve been bombarded with for the better part of the past decade lies somewhere intangible, coupled with capital and monetary expansion, the flight to safety becomes something we have traditionally been accustomed to as the real form of currency: precious metals. Gold has already shown its long-term buildup over the past few years; next are the higher-beta metals such as silver and platinum.

While we have already pushed for gold and silver Q1 this year, we still think there is room to run. Most G20 countries have been cutting interest rates and running deficits, as the global M2 supply charts show. What I foresee for 2026 is a gradual rise in metals, both steadily and in sharp bursts. Additionally, we will likely see central banks begin hoarding metals, with retail following very shortly after. Stocks at this point do not seem attractive.

While the economy still seems to be sustaining its growth through investments and the last fumes of the consumer, platinum and silver should follow the gold bull run into 2026, where we will ascertain whether the wane in demand continues. Share prices and performance of stocks like LULU, NKE, CAVA, and CMG have flagged a warning that the strains on purchasing power are becoming widespread, and preferences have shifted towards cheaper alternatives.