Q3 2025 Update - Adjustments to tariffs and the inflating bubble (not inflation)

Reviewing our previous insight post in late March, we had a bearish outlook and felt the market was overheated. We highlighted the various risks associated with deploying into equities from late March, and to a certain extent, that turned true when Liberation Day led to the S&P 500 and NASDAQ dropping almost 15% within 3 days. But following that was a tremendous, continuous rally, led primarily by the magnificent 7. The broader markets recovered within a few months to pre-liberation day levels and then broke through to all-time highs, which they have maintained to this day. During this period, we have participated in the upside through selective equity picks, notably a prominent position in Reddit Inc., and have been averaging our long-duration bonds (10-20 years) in anticipation of continuous rate cuts.

Our prediction that inflation would not rise due to tariffs has come true, at least for now. The general oversupply in production capacity means that this is a consumer-driven economy. Consumers dictate the equilibrium price. Suppliers maintain in an inelastic position and must bear most of the burden imposed by the U.S. import taxes.

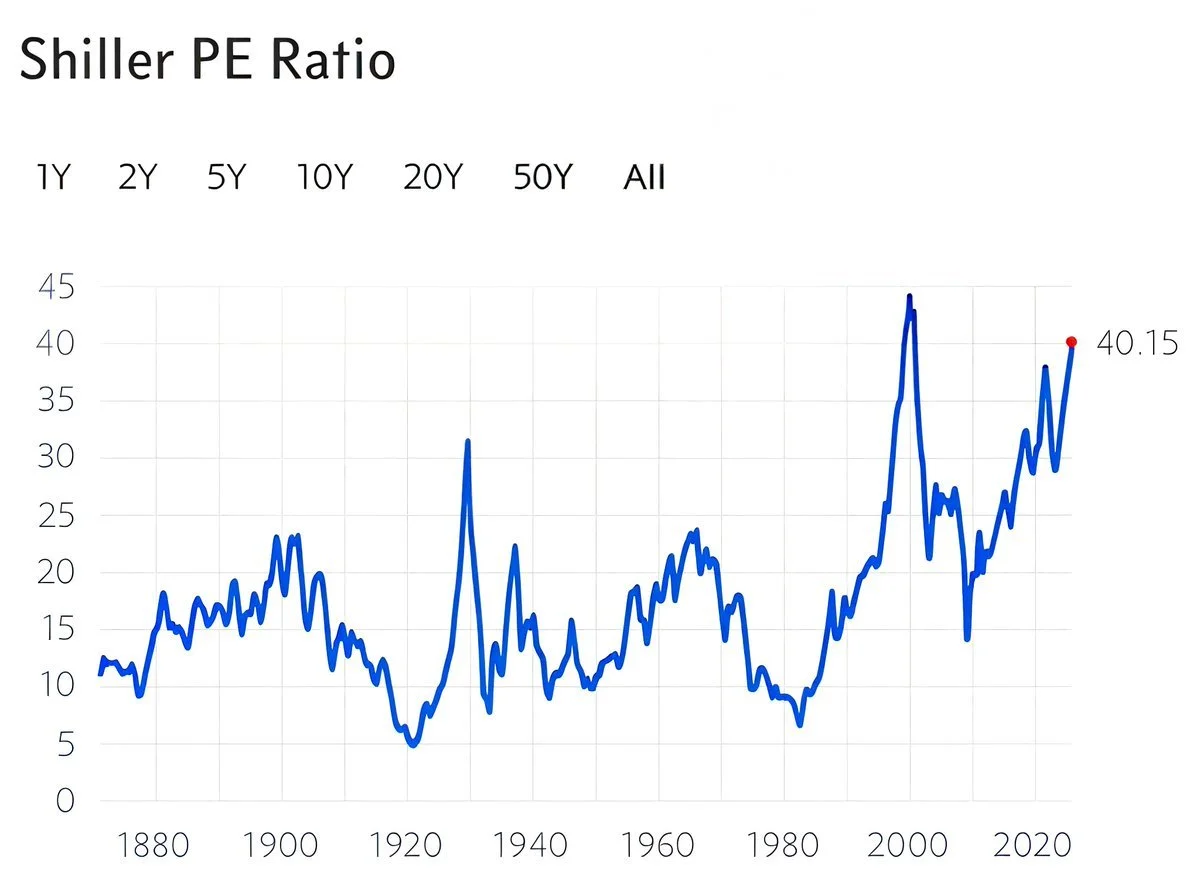

However, when we delve into valuations, a very precarious story emerges, and we have a fundamental basis to believe that the market may be getting ahead of itself. This is the third time the market has reached a Shiller P/E ratio of 40; the previous two instances were in 2000 and 2008. While history does not repeat itself, we believe it sure does rhyme.

We feel it in the outlook and sentiment of the marketplace. Every discussion topic, spanning corporate strategy, fundraising, investment, economics, and even casual social settings, seems to be now centered around AI. This translates to stock price movements. Any AI-related stocks can surge 20-30% on a random Tuesday due to rumors or speculation of a deal, and this is after months of the stock multiplying 2- 3x its value. Many of these AI names have essentially no revenue and trade based on “projected deals”. These are names like OKLO, SMR, QBTS, and IONQ. This is as clear a sign as any that we are near or at a euphoric state.

What tipped us to be cautious of the current state of AI are two recent observations. 1) These AI agent and chatbot providers are far from profitable, and 95% of companies that invest in AI do not see any tangible ROI 2) News that these players have begun scratching each other’s back (such as the $100B NVDA-OpenAI and the Oracle-OpenAI RPO deal). While I am a proponent of AI and its long-term benefits, we as humans often overestimate benefits in the short term. It is part and parcel of our human condition, and it's NOT different this time around.

Valuations don’t matter until they do; thus, we are selling off most of our high-growth equity positions and trimming our highest conviction picks (one of which is Reddit) while looking to remain in long-duration treasuries, precious metals, and stalwart companies. Our primary concern at this point is the weakening of the U.S. consumer, which is often drowned out by the more exciting AI chatter. Companies have begun using AI as a basis for laying off excess staff and seeking more cost-effective solutions to improve profitability. Concurrently, the federal government has cut wasteful fiscal spending and incentives. These material threats to the labor market have begun to make cracks in the labor reports and will eventually lead to reduced consumption; we will continue to monitor this trend closely.

We still believe that gold and, especially, silver have more upside potential heading into next year; thus, we have not begun trimming our positions. Investors are primarily focused on U.S. monetary policy for the projection of these precious metals. However, it is worth noting that the rest of the world has already begun cutting interest rates and expanding its money supply in response to deteriorating economic conditions. The data prove tariffs have hit exporters and producers (mainly in China/Korea/SEA) hard, as they are the ones primarily footing the bill. The U.S. CPI has stabilized, while the PPI continues to decline. Investors abroad have been piling into these metals not just because of uncertainty, but also to protect themselves agaisnt the risk of the destabilization of their own domestic fiat currency and a hedge against the USD.

The short USD position appears to be the most crowded trade this year, but recent charts indicate a potential floor. The weakening trend may reverse, and the USD could strengthen if the rest of the world experiences a decelerating growth. The risk-free rate in the U.S. remains elevated, above that of most developed countries. As long as investors can be comforted by the rising concerns related to sovereign debt, this should lead to a sustained growth in the appetite for U.S. treasuries/USD.

Additionally, if we assume that supply (exporters to the U.S.) is relatively inelastic, the implementation of import tariffs should not significantly impact the USD. On a medium-term horizon, the incentives and coercion to direct hundreds of billions of foreign capital into the U.S. should bring about an uplifting force. Therefore, piling on to the short USD trade at this time would not be advisable.

We believe the potential for value destruction and financial loss could be comparable to the dot-com boom. Nobody can predict exactly when, and shorting would not be wise, but it’s just a matter of time. For our long-term equities, we will also sell covered calls when the price of volatility becomes attractive.

How to position forward

1) Gold/Silver ETF (GLD/SLV)

2) Long-duration US bond ETFs (TLT/IEF)

3) Consumer Staples, Utilities, Tobacco (ETR, D, MO, SRE, PM)

4) High conviction equities (RDDT, CHA)